Introduction

In today’s fast-paced financial landscape, FinTech (Financial Technology) companies are at the forefront of innovation, leveraging cutting-edge technologies to deliver enhanced financial services. A critical backbone of this innovation is the robust use of Linux and open-source software. This article delves into the myriad ways FinTech relies on Linux and open-source solutions, highlighting their importance and the benefits they bring to the table.

Why Linux and Open Source?

Before diving into specifics, it’s essential to understand why Linux and open-source software are so prevalent in FinTech:

- Cost-Effectiveness: Open-source software is generally free to use, reducing licensing costs significantly.

- Security: The transparency of open-source code allows for rigorous security auditing.

- Flexibility and Scalability: Open-source solutions can be customized to meet specific needs and scale efficiently as the business grows.

- Community Support: A vast community of developers continuously improves and updates open-source projects.

Linux Servers: The Backbone of FinTech

Linux servers form the backbone of many FinTech infrastructures. Their stability, security, and scalability make them ideal for handling the demanding requirements of financial services. FinTech companies leverage Linux for:

- Web Servers: Hosting websites and web applications using Apache or Nginx.

- Database Servers: Managing large volumes of data using MySQL, PostgreSQL, and MariaDB.

- Application Servers: Running critical financial applications and services.

Containerization and Virtualization

Containerization technologies like Docker and Kubernetes, which predominantly run on Linux, are revolutionizing how FinTech companies deploy and manage applications. Containers ensure consistency across different environments, streamline DevOps processes, and improve resource utilization.

- Docker: Simplifies the deployment of applications by packaging them with their dependencies.

- Kubernetes: Manages containerized applications at scale, automating deployment, scaling, and operations.

Open Source Databases: The Heart of Data Management

Data is the lifeblood of FinTech. Open-source databases offer robust, reliable, and scalable solutions for managing financial data.

- MySQL and MariaDB: Popular choices for relational database management due to their reliability and performance.

- PostgreSQL: Known for its advanced features and extensibility, making it suitable for complex financial transactions.

- NoSQL Databases: MongoDB and Redis are widely used for handling large volumes of unstructured data and providing real-time analytics.

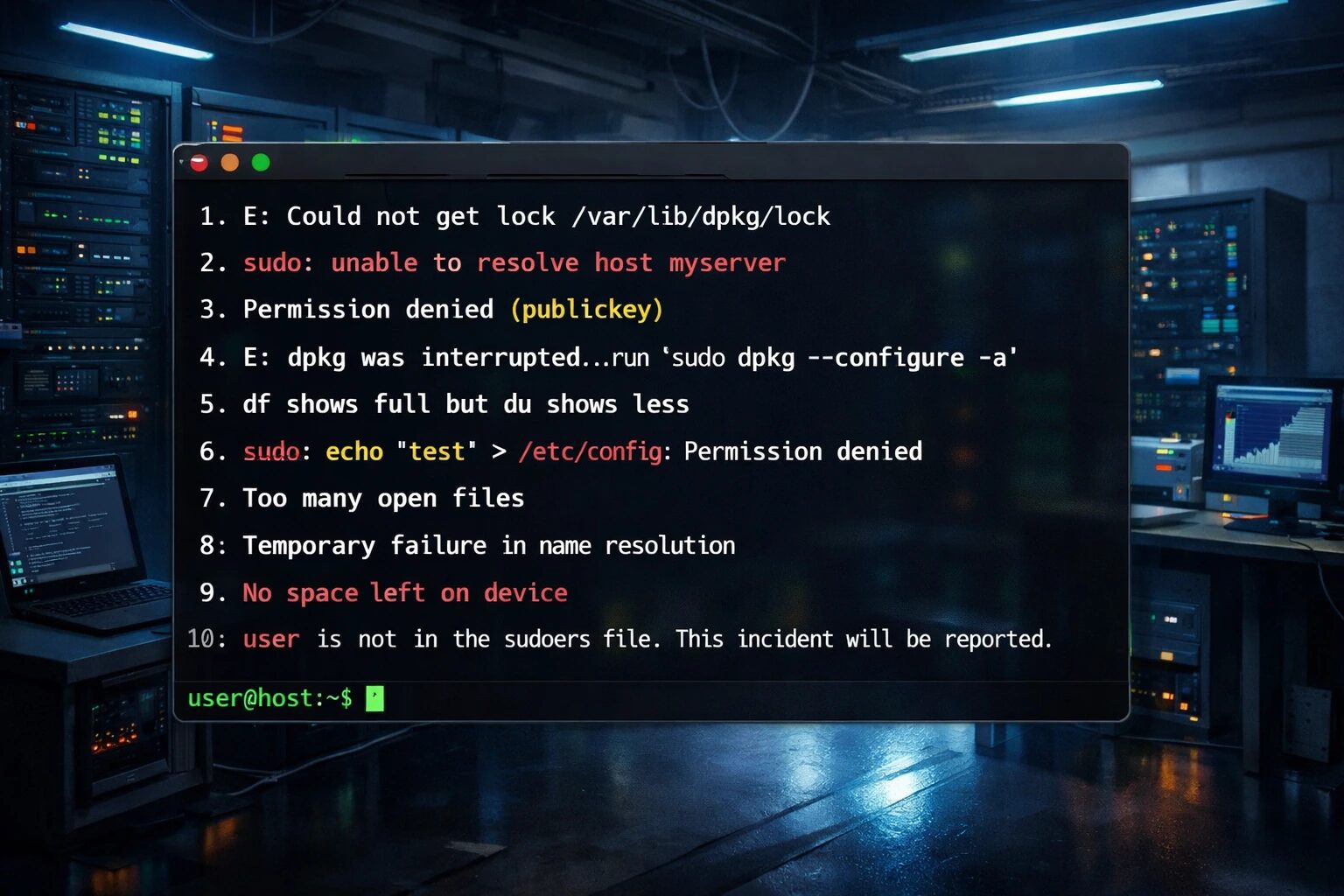

Security: Protecting Financial Data

Security is paramount in FinTech, and open-source tools provide essential security features.

- OpenSSL: An open-source implementation of the SSL and TLS protocols for secure data transmission.

- Metasploit: A penetration testing framework used to identify and mitigate security vulnerabilities.

- OSSEC: An open-source intrusion detection system for monitoring and responding to security threats.

Development and Deployment: Streamlining Processes

Open-source tools streamline the development and deployment of FinTech applications, ensuring efficiency and reliability.

- Git: A distributed version control system essential for managing source code.

- CI/CD Tools: Jenkins, Travis CI, and GitLab CI/CD automate the build, test, and deployment processes, enhancing the DevOps pipeline.

- Programming Languages: Python, Java, and Ruby, widely used in FinTech, are open-source and supported by large communities.

Data Analytics and Machine Learning: Driving Insights

FinTech companies rely on data analytics and machine learning to gain insights and make data-driven decisions.

- Big Data Tools: Hadoop, Apache Spark, and Kafka process and analyze large datasets efficiently.

- Machine Learning Libraries: TensorFlow, PyTorch, and scikit-learn enable the development of predictive models and advanced analytics.

Infrastructure: Building a Scalable and Flexible Foundation

Open-source infrastructure solutions provide the scalability and flexibility needed to support FinTech operations.

- Cloud Platforms: OpenStack allows for creating private and hybrid clouds, offering flexibility and control over the cloud environment.

- Configuration Management: Ansible, Puppet, and Chef automate the provisioning and management of infrastructure, ensuring consistency and efficiency.

Networking: Ensuring Reliable Connectivity

Open-source networking solutions are crucial for maintaining reliable and secure communication channels.

- Network Monitoring: Tools like Nagios and Zabbix monitor network performance and detect issues proactively.

- VPN Solutions: OpenVPN provides secure remote access, essential for protecting sensitive financial data.

Financial Applications: Innovating with Open Source

Open-source software is driving innovation in financial applications, from blockchain to trading platforms.

- Blockchain Platforms: Ethereum and Hyperledger are foundational for developing decentralized applications and smart contracts.

- Trading Platforms: Many algorithmic trading systems leverage open-source software for real-time data processing and decision-making.

Compliance and Auditing: Ensuring Regulatory Adherence

Compliance with financial regulations is critical, and open-source tools help ensure adherence.

- Regulatory Compliance: Open-source tools assist in maintaining compliance with financial regulations, reducing the risk of penalties.

- Auditing Tools: Kibana and Grafana offer visualization and monitoring capabilities to detect anomalies and ensure regulatory compliance.

Communication and Collaboration: Enhancing Teamwork

Effective communication and collaboration are essential in FinTech, and open-source tools facilitate this.

- Messaging Platforms: RabbitMQ and Apache Kafka provide reliable message queuing for seamless communication.

- Collaboration Tools: Mattermost and Rocket.Chat offer secure platforms for team collaboration and communication.

Conclusion

The reliance on Linux and open-source software allows FinTech companies to innovate, reduce costs, and maintain security and flexibility. By leveraging these technologies, FinTech companies can stay ahead of the curve, delivering enhanced financial services and driving industry growth. As the FinTech landscape continues to evolve, the importance of Linux and open-source solutions will only increase, paving the way for a more efficient, secure, and innovative financial future.